Omar, Abdul, and some of the SLC Econ Development Team Omar, Abdul, and some of the SLC Econ Development Team This week is National Small Business Week and to celebrate we joined the Salt Lake City Department of Economic Development and their Business Development team for their Redwood Road Commerce & Culture Food Tour. Our group of participants got to stop by three local restaurants, meet the owners, and get a taste of what business is like for these treasured establishments within our city. We definitely left FULL of great food and conversation! Our first stop took us to Global Place Somali Restaurant located at 1151 S. Redwood Road Suite 101 where we met met Omar and Abdul. While they told us about the history of the restaurant, their culture, and their plans for the future, our group dined family-style. Sombusa, crispy fish, pasta, and more! It was hard to not fill up at our very first spot. Global Place is a collective of businesses for the Somali community including a market, barber shop, tailor, the restaurant and also serves as a gathering space for their community. It was fun to walk through and check it out.  The Lavulo Family & Roberta of SLC Econ Dev The Lavulo Family & Roberta of SLC Econ Dev Next we ventured over to Pacific Seas, an authentic Polynesian restaurant that has been family-owned and operated for over 25 years. We kicked off our meal with Mango Otai, a deliciously sweet drink that we wanted seconds of. For food we tried Lu, (Taro leaves cooked in coconut milk), Sipi (lamb ribs), Umala, and some delicious sides. The Lavulo Family told us about each of the dishes and their stories about how they all come together to run the business together. City Councilman Alejandro Puy E also stopped by to join in the meal. Pacific Seas is also located at 1151 S Redwood Rd, Suite 107 and they are open every day except Sunday from 11am - 6pm.  Ishmael and Naweed of Noor Restaurant Ishmael and Naweed of Noor Restaurant As our group walked to the third location, Noor Restaurant, we were looking at each other like "Can we fit more food? We're so full!". But the second we walked into Noor we quickly decided YES WE CAN! All that was missing was the red carpet as the owners really pulled out all of the stops. Tender lamb shanks, chicken skoor with rice and chappatti (like a thin butter naan), beef KK, creamy jalapeno sauce, fragrant rice, and tasty noodles were laid on the tables just waiting for us to dig in. Another family-owned eatery, Noor has been in business since 2011 and you can tell why when you take your very first bite. Noor is located at 1151 Paxton Ave Suite 108, just around the corner of the building that houses all three of these great restaurants. They're open from 11am - 9pm 7 days a week. All in all it was a fantastic day and we are super grateful for the team at SLC Economic Development for putting it together and introducing us to all of these fabulous restaurants!

1 Comment

Ummm we have big news! Today we were recognized by the U.S. Small Business Administration’s Utah District Office as the SBA’s Microlender of the Year. Can we get a yee-haw?! 🤠 “The SBA understands that sometimes all an entrepreneur needs are a few thousand dollars to get their business up and running,” said Marla Trollan, Utah SBA District Director. “SBA Microloans were created to help small businesses and start-ups navigate the complex world of gaining capital. Without great credit, collateral, or so many years in business it can be almost impossible for entrepreneurs to get a traditional business loan. We are proud that the Utah Microloan Fund has been an amazing non-profit lending partner throughout the state of Utah." The National Small Business Week Awards Luncheon was held at Mountain America Credit Union in West Jordan. The event recognized the FY22 top performing SBA Lenders that administer the different loan programs the SBA has to offer. Delicious food, great company, and rousing speeches made the award ceremony a very special day. We're proud of our continued commitment to providing microloans and business advising to Utah's underserved communities and filling the financial gap for first-time business owners. Because of the support of the SBA, we are able to helps Utahns far and wide. Congrats to the other winners:

We can't wait to see what this year brings! ❤️ Are you a small business that often wonders what resources might be available for your business? Do you want to expand? Do you want to grow into new markets? Whatever stage you are in, this is the small business resource expo for you! Where: Business Technical Assistance Center @ 375 S Carbon Ave, Price, UT 84501 When: May 16th from 4-6pm Cost: Free! RSVP here Join us for an open house from 4-6pm where you can: - Network and learn about community and government resources available for helping small businesses. - Talk directly with representatives from small business and entrepreneurial support organizations about how they can help you grow your business. - Meet vendors who can help you with marketing, web design, and more. - Meet representatives from Helper and the Emery and Carbon Chambers of Commerce. - Learn about different funding options for your business. - Enjoy light refreshments while you mix and mingle. Participating vendors include:

Register now for the event here: Carbon & Emery Business Resource Expo  Hosted by the Business Technical Assitance Center.  So you're a small business owner who is in need of funding. Maybe you've bootstrapped it so far, borrowed from friends and family or even put together a Kickstarter. Whatever the case may be, if you are an entrepreneur who is now looking for a loan to help get you to the next step of growth, have no fear! Keep reading to learn some helpful tips that if followed could help you get the stamp of approval! As a brief intro, we are the Utah Microloan Fund, a non-profit organization that since 1991 has provided microloans from $5k - $50k to small business owners throughout the state of Utah. As a CDFI (Community Development Financial Institution) our mission is to help fill the gap of funding for first time entrepreneurs as well as underserved communities including minorities, women, Veterans, LGBTQ+, and rural. Over 30+ years of lending has led us to be pretty dang good at identifying what makes some applications meh vs outstanding so here's our list! Be proactive. 🏃♀️

Create a strong business plan & cashflow projection. ✏️

Request a reasonable loan amount. 💰

Have a clear Use of Funds. 📄

Don't even think about lying! 👀

Know your credit. 💵

Think of collateral or cosigner options. 🚚

Show off! ✨

By keeping these factors in mind and presenting a well-organized and thought-out loan application, you can increase your chances of getting approved for a loan. Good luck with your application and we look forward to working with you! Learn more at www.umlf.org.  Hey everyone, Sara here! You've probably seen me around at events, social media posts, or out and about but let me introduce myself. My name is Sara Day and I am the Program Manager of Training and Outreach for the Utah Microloan Fund. Which really is just a fancy way to say that my job is getting the word out about the UMLF and helping entrepreneurs across the state. Both of which I LOVE to do! If you follow us on social then you know that I have been traveling a bunch all over the state so I decided that I should start a travel blog on each of the unique areas I visit so keep reading if you want to tag along! I have always loved exploring all the little corners of Utah both big and small and learning about the history, vibes, and what's next for each area. My husband and I and our two dogs will pick a different place on the map and hit the road with our Utah Roadside History book & trusty trip journal and set out to fully immerse ourselves in that area. So you can imagine this is the perfect job for me because I get to do outreach across the state. Utah has an incredibly rich and diverse history. From our Indigenous tribes, pioneer history, mining, railroads, national parks, oil, tourism, skiing, the list goes on. As such, each of our 29 counties all face unique challenges, varied population density, booms and busts, different sources of income, etc. No two counties are the same and one solution does not fit all. But no matter where you go, there is always a chamber of commerce ready and willing to not only fight for the needs of their business community, but also bringing people together to support and nurture entrepreneurship. Many of these are run by volunteers! So you can imagine how happy I was to discover that a group of Utahns had put together the Rural Utah Coalition of Chambers (RUCC) whose purpose is to bring a united voice on the important causes that affect rural Utah businesses, share ideas and resources, and create dialogue with government officials and legislators. April 6th and 7th marked the 1st annual conference for RUCC and it was held at the beautiful Uintah Conference Center in Vernal, the Northeast corner of the state. Co-hosted by the Vernal Chamber, the conference was a big hit! Chambers from all over the state were in attendance to mix, mingle, and learn along with resource providers, government entities, economic development, local businesses and more. We heard from some amazing speakers on relevant topics to our state's rural areas - the economy, resources the chambers can bring back to their members, government programs available, grant writing and much more. There were also tours to local places of interest, my favorites being the the Hotel Vernal Haunt (scary even in the day time!) and the Innovation Hub for small business owners. We heard from City Manager Quinn Bennion about all of the huge changes the city of Vernal is implementing to revitalize their downtown and beyond. You can really see the love and passion behind all of these projects and how much people deeply care about their community. The organizing team behind RUCC did such an amazing job at providing a great conference for the over 200 attendees. We will definitely be back next year!  Flaming Gorge Flaming Gorge Lastly, Vernal is Dinoland and there is so much to do throughout the Uinta Basin. I am going to be ending my blogs with some of my recommendations for planning your visit to whatever area I journey to, so don't miss out! Here's what I have for the area: Don't skip the history. There is so much to see and learn. Definitely carve out a significant part of your trip for this!

Get outside. Hiking, biking, boating, swimming, ATV trails, you name it, await.

Look for treasures at the vintage/thrift stores.

Eat, Drink and be merry.

Watch the calendar. Vernal has a TON of cool events so keep an eye on their event calendar for all of the happenings.

Until next time! - Sara  Owner Jonathan Cagnacci Owner Jonathan Cagnacci Nestled in the heart of American Fork, Màstra Italian Bakery and Bistro has been a beloved destination for foodies, focaccia enthusiasts, and Italian cuisine aficionados alike. From its authentic, artisanal bread to its mouthwatering bistro fare, our April Business of the Month has captured the hearts and taste buds of locals and visitors alike. To learn more about the story behind this celebrated bakery and bistro, we e-sat down with its owner, Jonathan Cagnucci. In our conversation, he shared insights on the passion and craftsmanship that goes into every Màstra creation, his philosophy on cooking, and what's next for the bakery and bistro. UMLF: Hi Jonathan! We’re excited to interview you as our Business of the Month. Tell us about yourself. Jonathan: “My name is Jonathan I'm the founder and owner of Màstra Italian Bakery Bistro. I'm married to Stefania, and we have together two daughters, Nicole, and Elena. I grew up in Genova Italy, developing a spontaneous interest for food, history and serving others. In 2001 at the age of 17 I started working at Panificio Mario, a historical bakery in downtown Genova, where I found my own dimension between traditional food and timeless baking techniques. In 2015 after I graduated in Italy as a Master Baker Instructor, I decided to start my own restaurant in Utah, to achieve my dream to serve the community by sharing quality Italian food and the beauty of Italian tradition.” UMLF: For those who haven’t dined at Màstra yet, what can they expect from their experience? Jonathan: “Màstra Italian bakery bistro comes from the idea of offering to the community real great food made from scratch and an amazing value for the money Italian experience. At Màstra there is a family atmosphere and the food in our menu is not sophisticated but it's made to taste just authentic and amazing. The interiors are not luxurious, they look clean and bright and celebrate the art of artisan food making. At Màstra you won't find fancy servers but our welcoming staff making sure that you have a great experience. Everything at Màstra is designed so you can be nourished by the flavors, the warmth and atmosphere of Italy spending an unbeatable money for value price.” UMLF: One of the menu options that immediately jumps out as a fan favorite in your reviews is your focaccia! What goes into making this must-try bread? Jonathan: “Focaccia Genovese means a lot to me. It's an important piece of my life and heritage. The Focaccia itself (fugassa in Genovese) derives from the Latin word focus, which means baked in a fireplace. The Focaccia Genovese was born in the harbor city of Genova in the Middle Ages, and it remains remarkably popular today. Bakeries across the city still bake focaccia all night through the morning, and almost everyone buys a slice daily. In Genova, focaccia is not just food, it’s a secular ritual. At the end of ‘500 in Genova, focaccia was so popular it was enjoyed with wine and other treats as part of wedding celebrations. Legend has it that since these celebrations occurred in church, focaccia eventually became a popular appetizer during funerals too. This tradition was quickly put to an end by the local Bishop Matteo Gambaro. He threatened to “excommunicate anyone, aristocrats or plebeians” as fugassa was deemed too joyous for such somber occasions. This portable, delicious flatbread is the beloved food of travelers, workers, and students even today in our times. For Màstra It's a true privilege to exclusively offer this delightful bread and charming tradition to the community here in Utah.” UMLF: The quality of your ingredients seems incredibly important to you, what is your process for sourcing the items that go into your dishes? Jonathan: “Since 2015, when I moved here, I began selecting as many local affordable quality raw materials as I could, to cook my family recipe for my relatives and friends. Still today I keep asking my friends who are part of the Italian community, if by chance they found any quality ingredient I can use in my kitchen. At Màstra we currently use over 20 ingredients imported from Italy, sourced from 6 different stores. We also use local flours and about 600/month organic basil plants locally grown, to make our fresh Pesto Sauce.” UMLF: Every business has its highs and lows. Can you tell us about a challenge you faced as an entrepreneur and how you overcame it? Jonathan: “We first opened the restaurant doors in February 2021. Things started going great for us from the very beginning. Locals were super excited to finally have an authentic Italian restaurant in Utah County and so, pretty soon we began to be pretty popular and appreciated. A few months later in the October of the same year, my family and I had to go to Rome, for a two-week trip to get our US work Visas at the US Embassy. Well at that time this specific US Embassy was really overloaded with work, due to a shortage of employees from Covid 19, and the enormous amount of refugee Visas they had to issue for the Afghanistan crisis. So, our two weeks trip became a nightmare where my family and I got stuck in Italy, without the option to come back to the US, far away from my young business, our house, school, and lives. During this time, Màstra employees strived so much to keep the service consistent and make the customers happy. And so, after six weeks we all agreed that it would be just impossible to offer a sufficient service with such a reduced staff and lack of management. So, I had to close my young bistro, let go all of my employees, suppliers, connections, customers... everything. Even worse was the fact that I didn't really know if I would ever be able to open the restaurant again. In February 2022, after 4 months stuck in Italy, without ever hearing once from the Embassy, we finally got contacted about our Visas, and we were able to come back to the US and Utah. As we returned it took me a while to come back to check the restaurant. I was afraid to go see what was left there. After four days I took courage to go check. At this point I found this dusty, empty, quiet dining room. No customers were there, nor employees. No delicious smell nor laughs and cheers. Just desolation and ashes. Restarting again from the ground has been one of the hardest things I've ever done in my life. At that point, it was almost impossible to find employees and to reconnect to my original network. I'm a pretty optimistic guy and I rarely cry. Nevertheless, I remember one night, driving back home, after I spent the whole day trying to train these unskilled new guys, I found myself lost in tears. That night for a minute I really thought that I couldn't make it again. It's been a year since that chapter of my life. Today Màstra is stronger than ever, and business is doing amazing. Looking back, I feel humble and truly grateful for the support that I received from my family, employees, friends, customers, and local food bloggers that helped me to put back together all the pieces, one brick on top of another.” UMLF: How do you feel like the Utah Microloan Fund has helped your business? Jonathan: “Utah Microloan has been precious for the rebirth of my business. After 3 months since I reopened, I realized that I needed some new and better equipment to speed up my production and improve efficiency without having super skilled staff available. I needed some funds to fill that gap caused by losing my previous trained employees. UMLF has been a great tool that helped me to relaunch my business, in a short time. Still remember TJ has been so helpful and patient helping me to fill up and submit all the forms and information required for the loan. I also remember the day of my final interview with Brandon. He made me feel he was believing in me as an entrepreneur and in my project. That gave me that extra confidence that I needed in that controversial time of my venture. I'm still really grateful for UMLF for trusting me, believing in my project, and giving me the opportunity to boost my operation taking my kitchen to the next step.” To plan your visit to Mastras check out: Address: 476 N 900 W American Fork, UT 84003 Web: www.mastraorders.com Facebook: Mastra Italian Bakery Bistro On March 21st, 2023 Square Financial Services announced the recipients of the 22 Squared Grant Initiative, a microgrant program launched in partnership with the Community Foundation of Utah. For the second year in a row, the program awarded microgrants to Utah-based nonprofits that focus on at least one of Square Financial Services’ community development pillars: small business development, affordable housing, reentry support and entrepreneurship, and financial capability and wellness.

In addition to providing 19 grants of $2,200 to nonprofits across the state, Square Financial Services awarded grants of $5,000 to three organizations for exceptional and innovative community development work: Utah Microloan Fund (UMLF): The Utah Microloan Fund empowers underserved communities throughout Utah by providing microloans up to $50,000, as well as business advice, classes, and management support to entrepreneurs. Over half of UMLF’s clients are recognized as being low-to-moderate income, and nearly one-third identify as women or minorities. UAACC Charitable Foundation: The Utah African American Chamber of Commerce (UAACC) Charitable Foundation is dedicated to developing young Black professionals, providing resources to small business owners, and growing wealth in Utah’s Black community through its wide breadth of programming. Working with various organizations across Utah, the UAACC offers mentorship and apprenticeship opportunities to high school students and young professionals of color with the goal of increasing the pipeline of Black talent from 8th grade to the C-Suite. Circles Salt Lake: Circles Salt Lake is focused on breaking cycles of poverty and addressing the systemic barriers people in low-income communities regularly face. As a community-led initiative, Circles staff and volunteers collaborate to offer financial literacy education, mentoring, peer-to-peer counseling, and connections to basic but vital resources like transportation, healthcare, and job opportunities. “We recognize the growing need for both funding and education for business owners in Utah, especially in underbanked populations,” said Doug Keefe, Executive Director of the Utah Microloan Fund. “Self-employment and microenterprise development offer a significant opportunity to provide income, and with this grant, we’ll be able to expand our grassroots outreach and offer resources to traditionally underserved communities across the state.” “Nonprofits throughout Utah have had a transformational impact and can help revitalize local communities,” said Lew Goodwin, CEO of Square Financial Services. “Many of last year’s grant recipients have provided programming, financial resources, and education to small businesses and entrepreneurs in minority, refugee, and low-to-moderate income populations. In partnership with the Community Foundation of Utah, we’ve expanded grant funds by nearly 30% this year to help even more nonprofits make strides in the critical community development work that ultimately leads to economic empowerment.” For a full list of winners, please visit: https://utahcf.org/community-impact/initiatives/293#2023-awardees About Square Square helps sellers more easily run and grow their businesses with its integrated ecosystem of commerce solutions. Square offers purpose-built software to run complex restaurant, retail, and professional services operations, versatile e-commerce tools, embedded financial services and banking products, buy now, pay later functionality through Afterpay, staff management and payroll capabilities, and much more – all of which work together to save sellers time and effort. Millions of sellers across the globe trust Square to power their business and help them thrive in the economy. Square is part of Block, Inc. (NYSE: SQ), a global technology company with a focus on financial services. For more information, visit www.squareup.com. Worthfull Media is the Utah Microloan Fund's March Business of the Month, and we can't wait for you to learn more about them! We digitally sat down with owner Christine Baird to learn all about Worthfull and what makes them worth every penny! UMLF: Hi Christine! We’re excited to interview you as our Business of the Month. Tell us about yourself. Christine: "Hi and thank you! I am a media producer who loves podcasts, hosting, and design. After years in corporate sales, I did a career 180 and have been working in podcast production and media strategy since 2014. I worked on Lewis Howes’ brand, The School of Greatness, for four years, where I grew his top-ranked podcast from less than 1 million downloads to over 80 million. In 2018, I stepped away from producing that brand, moved to Salt Lake City from LA, and started Worthfull Media. Since then it has grown to support dozens of small businesses, personal brands, and larger endeavors in launching and growing their shows and impact." UMLF: For those who need the 411, tell us about Worthfull Media and what you do? Christine: "We are a boutique media production house that serves seasoned coaches, consultants, speakers, and authors who want to podcast and YouTube. Our core values are worth and well-being. We LOVE what’s possible when experts share their wisdom through podcasting and YouTube. We think it’s one of the very best ways to connect our human race and share the knowledge we are learning together. Our core values come from nearly a decade of working closely with recognizable personal brands and seeing the power — and pitfalls — of making media in the digital age. We make shows that share your most enticing ideas, thus attracting your ideal audience, without sacrificing your well-being or self-worth. We call it worthfull media." UMLF: What are some of your favorite productions that have taken place at the studio since you opened? Christine: "I have loved having my longtime friend and now client Magalie René in studio twice in the past few months to film two seasons of her new YouTube show, The C Word. She's a brilliant compassion and confidence expert who facilitates trainings in the corporate environment, plus she has great style and personality, so it's been really fun to bring her wisdom to a YouTube show and give her the full support of a studio and team. We also recorded Season 3 of our own podcast, Think Like a Producer, with my co-host Tiff Tyler, and we brought in guests to be our case studies as we showcased how to put together great video episodes in studio." UMLF: Do you have any advice for people who are thinking about getting into podcasting?

Christine: "Yes! It's a super powerful medium to share your expertise and ideas with your existing audience. No other media format creates the kind of intimacy that podcasting does, however, no one is very good at it when they start. So start! You'll get better as you go and learn a lot along the way. You'll pick up skills like owning your voice, being comfortable speaking publicly, and it may lead you to opportunities you could never imagine. It's a lot more fun when you hire people to help you with production, but it's okay to start on an amateur level and find your way." UMLF: It’s Women’s History Month. Do you feel proud of your accomplishments so far as a woman-owned business (you should!) and what does the future look like for you? Christine: "I do feel proud of myself for how far I've come as a small business owner. It was never my plan, but the path kept opening in front of me, and it's where I see the biggest possibilities for me to contribute to the world. Working in a male-dominated industry like online media, it's been really interesting to see how valued a female perspective and emotional intelligence is, so I plan on leaning more and more into those talents as I build out my team and clientele. We are doing way more YouTube shows now, which is why we opened our studio, and I see more of our future work being video-first." UMLF: Every business has its highs and lows. Can you tell us about a challenge you faced as an entrepreneur and how you overcame it? "I think I've become so used to self-doubt, I'm numb to it, haha! It's been a wild ride to expand my business from a solopreneur shop to a full agency with a brick and mortar studio coming out of a pandemic, but I've learned to trust the next right step instead of trying to figure out the big picture right away. One of my biggest challenges is keeping in my lane and focused on what I know I do well, rather than getting tempted to just do it the way everyone else has been doing it. I want to make media better, so that means doing things differently." UMLF: How do you feel like the Utah Microloan Fund has helped your business? Christine: "Having kept my business fully remote until last year, I hadn't prepared for a physical location expansion in my business. But I kept getting the idea and seeing the possibility and then I found the perfect space, so I needed support to bridge the gap in my finances. UMLF was so helpful for a non-traditional business like mine that had been mostly a solo operation up until that point, and I'm so grateful for their support in thinking through how to make this expansion successful." Website: https://worthfullmedia.com Instagram: www.instagram.com/worthfullmedia Facebook: www.facebook.com/worthfullmedia  "For me, I just want my clients to feel like they are in a safe space. It's really about giving people time and the effort of allowing them to be seen." We love the philosophy of Josh Lucero, veteran hair guru and owner of the newly-opened Lucero Hair and Wellness salon. Located at 1095 S State Street in downtown Salt Lake City, we would like to introduce you to our February Business of the Month. Keep reading to learn more! UMLF: Hi Josh! We’re excited to interview you as our Business of the Month. Tell us about yourself and why you started doing hair? Joshua: "I'm honored got be here and to have this platform to share my experience. I have lived in Utah for 16 years and have truly called it my home for the last 5. I grew up in phoenix and have slowly transitioned to the cold and the environment. I have had a traumatic childhood that has helped shaped me into the man I am today. With that being said, I had hit my rock bottom in life and hair saved me from myself. I have been doing hair for 10 years, and have finally been able to open my own hair studio, Lucero Hair and Wellness." UMLF: Lucero Hair and Wellness is an inclusive hair salon. Can you tell our readers more about what that means and the importance behind the decision? Joshua: "Of course! The past ways to book your services was as a “Men’s Haircut” or a “Women’s Layered Haircut” or any different variation of that. We have decided to do time-based services instead. This allows us to remove the gendered aspect of haircutting, and focus on the individual and their hair. We have clients who identify as a women, who have faced gendered haircuts, and vice versa for men. We also have people who identify as non-binary who have struggled to find somewhere to feel safe and seen, and we have decided to create that space for them. We aren’t the first to do it this way, but we are the first to push inclusion and acceptance." UMLF: What are some of your favorite services that are offered at the salon?

Joshua: "I love a good one hour hair service. I like to add a hot towel wrap, straight razor neck shave, and deep condition after a relaxing wash. I love to be pampered, so I would even book an hour and half and have someone give me a facial!" UMLF: Every business has its highs and lows. Can you tell us about a challenge you faced as an entrepreneur and how you overcame it? Joshua: "Honestly, nobody teaches you how to do this. Especially in a tech college program. You literally start at the roughest draft and have to scrap the bottom and find resources. I wish there was an easier way for people to find resources and assistance. I am on a board for the Utah Hair and Creative Association, which helps people in creative industries find the resources they need to succeed. I hope to help people find their own success and to really push them to lead a team. Not everybody wants that, but allowing them the opportunity creates trust and community." UMLF: How has the Utah Microloan Fund helped your business? Joshua: "The skills and assistance to truly have the money has been monumental in my success. The UMLF has been a great advocate in bettering our communities and allowing business to thrive." Thanks Josh! Lucero Hair and Wellness also offers facial waxing, shaves, hair systems, color services, facials and more. To check out all of their offerings visit: Website: https://lucerohairandwellness.com Facebook: www.facebook.com/jlucerohair Instagram: www.instagram.com/lucerohair_andwellness  Owner Tania Rodriguez Owner Tania Rodriguez UMLF: Hi Tania! We’re excited to interview you as our Business of the Month. Tell us about yourself. Tania: "I'm originally from Chihuahua Mexico, I shared the same dream as many as those who came to this Country, to build a better life for me and my family, I have lived in Ogden Utah for more than half of my life, my favorite part of Utah is the mountains and the people, Ogdentines accepted me and opened their arms to me until they made feel that I'm one of them, so this is my place to stay, Ogden is now what I can call home." UMLF: Tell us about Los Churros del Norte and why you decided to start your business? Tania: "Los Churros del Norte started as a business idea that with a lot of sacrifices and work it's now a reality. I'm a big fan of small business ownership, I think it's the backbone of American innovation. But to be successful you first have to have the courage to go for it. I'm an immigrant and Ogden is now my home. From a very young age I discovered that my mission in this life is to serve others, at the age of 12 I began my volunteer service and I continue to do so. Now I have a family to support and I had to find a way to generate money to continue helping others, now I not only help through the American Red Cross but also do my bit through my small business that one day will make a difference in our community, none of this could be possible without the support of my husband, my family and my community." UMLF: What are some of the different kinds of desserts you make and which is your favorite ? Tania: "We make 'Authentic Mexican Churros from scratch and by hand with dipping sauces like homemade dulce de leche, chocolate or vanilla. Coconut mango rice pudding and sopaipillas topped with strawberries and bananas, whipped cream and chocolate, dulce de leche sauce. My favorite is the churros because nobody makes them from scratch and in every bite the flavors take me to Mexico where I'm from." UMLF: Where can people find your delicious goodies? Tania: "People can find me in different events around Weber and Davis county, we often post where we will be on our Facebook and Instagram." UMLF: Every business has its highs and lows. Can you tell us about a challenge you faced as an entrepreneur and how you overcame it? Tania: "The challenge that I faced as a small business owner was to start, it was hard to start and know that all can go wrong, but I consider myself a risk taker and I had to do it, I worked hard and I kept trying. It can be scary to start a business on your own, but I found great leadership and guidance from ULMF. I'm very grateful for them." To stay in touch with Los Churros follow them at:

Small business owners have a lot on their plate. Between managing employees, dealing with finances, and trying to grow their business, it can be tough to find the time or resources to pursue new opportunities. That's where microloans come in! Here are five reasons why small business owners should consider a microloan:

Overall, microloans can be a great option for small business owners looking for flexibility, speed, and personalized support. If you're a small business owner considering your financing options, it's worth considering a microloan as a way to get the support you need to grow your business. If you are interested in pursuing a microloan please call (801) 746-1180 or visit our website at www.umlf.org. The Utah Microloan Fund's Building Your Business series is a valuable resource for both brand new startups and business owners looking to grow their companies. The series, which is held virtually on a rotating schedule, consists of four classes: Proof of Concept, Pricing Strategy, Mastering Your Cashflow Projections, and Writing an Effective Business Plan. These classes are free and all are welcome to attend.

Overall, the Building Your Business series is a valuable resource for business owners of all levels. Whether you're just starting out or looking to grow your existing business, these classes provide the knowledge and skills needed to succeed in the competitive world of entrepreneurship. Also by attending and learning about topics such as market research, pricing strategy, and financial projections, business owners can demonstrate to potential lenders that they have a strong understanding of their industry and the financial management skills needed to successfully grow their business. If you are considering applying for a microloan, this is a great place to start! About the UMLF: The Utah Microloan Fund has helped make business owners' dreams a reality since 1991 by providing business training, mentoring, and microloans up to $50k to Utah small business owners. We help people who:

To learn more visit: www.umlf.org or give us a call at 801-746-1180 Is there any better feeling on Earth than warming up your cold hands? Our December Business of the Month doesn't think so! Keep reading to learn more about Toasty Touch and why they should be #1 on your gift lift this year. 🎄 UMLF: Hey guys! We’re excited to interview you as our Business of the Month. Can you introduce yourselves to our readers? “We're Nico and Natalie Dicou, co-founders of Toasty Touch and inventors of the world's thinnest heated gloves. We're a married queer couple. We work best when we're together, so you'll always find us strategizing and putting our brains together to solve a business dilemma. It's fun being in business with your best friend.” UMLF: Tell us about Toasty Touch and why you decided to start this business? “We started Toasty Touch because we saw that this product was not on the market and we decided that we could bring it to life. In Fall 2020, Natalie got diagnosed with Raynaud's, a circulation condition where your hands become icy cold and white in mildly cold temperatures. She tried every heated glove on the market, but they were all too bulky or too thick. You couldn't do the things you wanted to while wearing them. The bulky heated gloves made your hands warm, but you couldn't even pick up a phone call while wearing them. Natalie became obsessed with the idea of making battery powered heated gloves that were thin enough to let you type with or make a phone call while wearing them. Here's a blog she wrote about it: https://toastytouch.com/blogs/coldhandsblog/imafrostyblog UMLF: We’re sure there was a lot of trial and error with bringing your gloves to life. Can you tell us about your creation process?

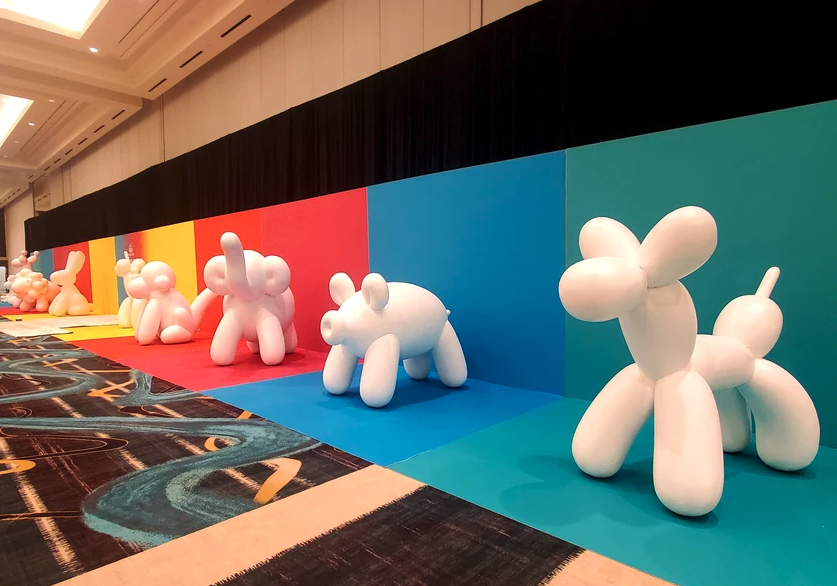

“Creating these gloves took patience and effort, for sure. We had so many prototypes and designs and feedback sessions with our manufacturing team. We really wanted the fabric on the gloves to feel luxurious and comfortable, not too tight or rigid. We added touch screen pads to the fingers so you could use them with your phone or typing, and also made it so they are comfortable enough to wear for an extended period of time. They have three heat settings, and the rechargeable batteries fit into a small zipper pouch under the wrist. Right now we carry the gloves in the color black, but gray and navy blue will be hitting our store in a few weeks!” UMLF: Your gloves can obviously benefit so many people for different reasons! Have there been any surprising ways people have utilized your gloves that you didn’t expect? “We love hearing from customers on how they're using our gloves. While these were developed primarily for indoor use because of their lightweight nature, people from all walks of life have been using them. We've learned that crossing guards, photographers and mail carriers are big fans of Toasty Touch heated gloves. Anyone with cold hands can benefit from warm, soothing heat applied consistently all the way to your fingertips. Our reviews (https://toastytouch.com/pages/reviews) describe our product as "game-changing" and "life-altering". Our customers' reviews literally bring tears to our eyes when we read them because we know how much they are helping people. It's really wonderful to be a part of.” UMLF: Entrepreneurship has its highs and lows. Can you tell us about a challenge you faced as a small business owner and how you overcame it? “We started this business almost a year ago in February. We picked a date to launch and announced it on our social media platforms. The day came, and we had tons of interest on our site and traffic coming from all over. We set the stock levels and launched the store. No sales. But there were tons of people on the site! What could be going on? Nico realized that on our product page, during a website theme update, the "add to cart" button had been accidently deleted and was not displaying. So there was no way for customers to check out! It was beyond frustrating to realize! After designing and implementing our whole store and launching the site, Nico had forgotten to double check the add to cart button was live! In that moment, Natalie gave a good pep talk to Nico, she refocused and added it back to the store with a little on the fly coding. We were able to get back on our feet and have an exciting first sales day of our ultra-thin heated gloves. It totally was unexpected and just something we had to work through together It just goes to show that even when you plan for everything, things you already thought were covered pop up and say "Pay attention to me!" As an entrepreneur it's up to you. You have to handle these moments with grace and patience, and it will most likely make you laugh looking back at it!” UMLF: How has the Utah Microloan Fund has helped your business? “The UMLF helped our company Toasty Touch immensely by providing a loan to our business when we were needing to ramp up our Google ad spend and order more inventory. It could not have come at a better time because it set us up for success and our biggest sales months ever. Thank you to the UMLF team for believing in us and helping us get our ultra-thin heated gloves out into the world!” To stay in touch with Toast Touch visit: www.facebook.com/toasty.touch www.instagram.com/toasty.touch https://toastytouch.com  UMLF: Hey Will! We're excited to interview you as our Business of the Month for Xtreme Foamworx. Can you introduce yourself to our readers? "I am Will Laird; I grew up on a large cattle ranch outside Evanston, Wyoming, where I acquired many skills I use in my business today. Grit, hard work, and determination that I can do anything are some of those skills I use. I have lived in the St George area for five years. My wife and I have come to enjoy the St George area and the people we know in this area. I am the father to 2 amazing boys who are in sports and school. I volunteer as a football coach on my son's team and enjoy fishing and hunting when I get the time to do so." UMLF: Tell us about Xtreme Foamworks and why you decided to start it. Will: "Xtreme Foamworx is a custom foam fabrication business. We take large billets of foam and make almost anything a person can think of out of that foam to serve its purpose. I have been in this industry for 10+ years now and have made a point to be the one to make the "impossible" possible. We started the business because we desired to take more control of our financial future and to serve the area with a local shop to handle the needs of our growing city. When I moved down to St George, I left a similar business up in Utah county and had many business friends who wanted us to start a foam company. So we started up Xtreme Foamworx LLC. We started with a 5000 sq ft shop in Evanston, Wyoming and a portion of the shop in St George. We made many weekly trips up and back to the Wasatch Front to get materials and deliver goods. After a year and a half, we could start completing truckload orders and making fewer trips with more work. In 2019 we hired our first employees in the St George area, and things took off." UMLF: For someone who isn't familiar with foam fabrication, what are some of the things people can order from you? Will: "At Xtreme Foamworx, we make custom stuff. We have helped make prototypes to large runs of architectural shapes for the stucco to packaging components for all types of products. We have become known for our large sculptures. We serve anyone from a single person to large-scale businesses." UMLF: You get to work on so many cool things. Do you have a favorite project you can tell us about? Will: "Some of my favorite projects we have worked on have been the big ones! The 1st large project we took on was the Evermore Park pumpkins. This project tested our new business in 2018 to produce 26 pumpkins that would range in height from 6ft tall to 24' tall. We had five weeks to create these and made it on schedule. Another project was a much more recent one, and that was working with Tuacahn Theatre on their sets for the 2022 summer shows. We made large props and set pieces that they designed. We made the parts with different foam densities and hard coats, and then they did the magic of scenic painting for a fantastic set. One last one was from 2021. Paparazzi reached out to us,and we had to excellent opportunity to make some amazing sculptures for their event in Las Vegas. We made ten balloon animal sculptures that were 6 ft tall to 10 ft tall and some signs and large letters. Lots of creativity, time, and hard work went into each project. I don't always know the exact method. I will build some of the projects that come, but we always find a way. What makes these projects my favorite is the creative aspects we had to approach these with to make them." UMLF: What would your dream project be? Will: When we get creative projects, we always enjoy them and their challenges. The dream project is creative, complex, and fully funded. I would love to make the dream set sculpture or feature for someone with the budget to do it and the timeframe to make it fit their dreams. UMLF: Entrepreneurship has its highs and lows. Can you tell us about a challenge you faced a small business owner and how you overcame it? Will: "One of our toughest challenges was getting our funding into place once we established business. We were initially funded by a family friend who gave us a three-year loan to build machines and get up and going. Once we had the machines built and business was moving forward, we realized we needed to grow to be more successful. In the last two years, we have struggled with establishing credit limits with our vendors as we didn't have a company credit card until last year. We had to pay for all materials upfront, and most customers would pay COD or net 15. As we have grown our customer base to larger companies, they will extend us to a net 30-45. I had to be the squeaky wheel and push to meet with the right people to get our credit line with our leading supplier. This was a six-month struggle, with me persisting with my sales rep, his supervisor, and the company's vice president to arrange a meeting to get set up. Once I accomplished the line of credit has helped us grow and maintain a much better cash flow." UMLF: How has the Utah Microloan Fund has helped your business? Will: "Utah Microloan Fund was vital in helping us gain the working capital we needed to grow our workforce to handle our increased workload. The process with UMLF was straightforward. We had a guiding hand through the process; if any questions arose, we had someone to reach out to and help. We have been highly grateful for the willingness of UMLF to help small businesses that banks want to turn away before they know the business. I have recommended the UMLF to many entrepreneur friends in the state to get their businesses to the next step." To check out more from Xtreme Foamworx visit: Website: www.xtfoam.com Facebook: www.facebook.com/Xtfoam Instagram: www.instagram.com/xtreme_foamworx  Owners Marley Nelson & Kelsey Grunigen Owners Marley Nelson & Kelsey Grunigen UMLF: Hey guys! We’re excited to interview you as our Business of the Month. Can you introduce yourselves to our readers?

UMLF: Tell us about Wild Mesa and why you decided to start your own biking venture?

UMLF: Are these tours better for beginners or all skill levels?

UMLF: In an outdoor state such as ours there are lots of different companies to choose from when booking a tour. Why is Wild Mesa a cut above the rest?

UMLF: Entrepreneurship has its highs and lows. Can you tell us about a challenge you faced a small business owner and how you overcame it?

UMLF: How has the Utah Microloan Fund has helped your business?

UMLF: Aw thanks guys! To stay in touch with Wild Mesa or to book a tour please visit: August is Black Business Month, a time to acknowledge and appreciate Black-owned businesses across the nation and all they represent in America's continual striving for diversity and equality. While it is of incredible importance to focus your efforts on these communities during the month of August, it goes without saying that this should be kept top of mind year-round.

Why?

So what are the best ways to get involved? With Your Dollars Shop at Black-owned businesses. Restaurants, hair salons & barber shops, clothing stores, gifts -- Utah has it all if you know where to look! Two of our favorite directories of local Black-owned businesses throughout the state are:

With Your Network Even if you’re not able to monetarily support Black owned businesses to the extent you would like, spreading the word is just as important! Building awareness is something you can't put a price on.

With Your Connections Utah has some pretty amazing resources for small business owners, but people don't always know about them.

Our mission is to help small business owners across the state of Utah access funding and training, with a focus on the underserved. Our microloan program is available to business owners wanting to get their idea started or to grow their existing business. In addition, the UMLF provides virtual classes as well as a digital class library for small business owners. These are free and open to the community. Learn more here: UMLF Classes Use the hashtag #utahblackbusiness to tag your excursions and make a habit of celebrating Black businesses this month and every month. ❤️  Owner Elif Ekin Owner Elif Ekin Located in a beautiful restored Victorian in downtown Salt Lake City, Kahve Cafe with Turkish Coffee and Mediterranean inspired sweets and savories. Never tried an authentic Turkish Coffee? Don't worry, owner Elif Ekin is going to walk you through the experience of Kahve, our August Business of the Month. UMLF: Hi Elif! We’re so excited to interview you as our Business of the Month. Tell our readers about yourself. Elif: My Name is Elif and I have been an entrepreneur for over 10 years with my business Bohemian Baklava where I provided fresh baklava to various restaurants and cafes around town. I am a single mom of teenager who has become quite the sidekick with me as we run this new café business venture. I am of the mentality that if I want Mina to go after her dreams, no matter how hard, I must first step in to show that it can be done. I am half Turkish / half American and grew up on the East Coast in RI. I moved to Utah 21 years ago when I first got married and stayed even after I got divorced because I loved how Salt Lake City is so supportive of small businesses and entrepreneurs. The level of community support and assistance is something that I wouldn’t be able to find if I had moved back East. As a single mom, I wouldn’t be where I am now without this community that I can turn to as I have navigated all the ins and outs of the various businesses I have done over the years. UMLF: What’s the story behind Kahve Cafe and how you got started? Elif: Kahve Café is my pandemic Pivot. When the world shut down, so did all the restaurants and cafes which sort of killed the baklava business. If I was to keep this baklava business from dying, I had to pivot and pivot hard. I had been saying for years that I had wanted a Victorian downtown to be able to house all the things that I do and one presented itself in June of 2020. It took until February of 2021 to be able to get keys, but I needed the time to really work out what I really wanted the café to embody. People had asked me to years to open a Turkish restaurant, but I knew I didn’t want to do all that. A Turkish Café was do-able. For years, friends would come over to my house for Turkish tea and coffee and just stay for hours talking because it felt like home. That was the essence I wanted to infuse the café: the feeling of home and family. Turkish Hospitality begins in the home, and therefore having a Victorian home was an important element for the environment. I want people to feel like that are family and it has been lovely to see UMLF: What can someone expect from their first visit to Kahve? Elif: I like to think of a visit to Kahve like visiting your old quirky aunt who has traveled the world, collected eclectic treasures to decorate the house. I want it to feel like you have come home, like visiting long lost family. There are lots of little nooks and crannies to hide away in with a good book as you drink your unlimited tea. I want people to feel like they aren’t in Salt Lake City anymore and went traveling abroad. It takes a minute to take in all the things because the environment is so different than any other café around. We guide you through the whole process and explain all our different drinks, pastries, and savories. Kahve Café is an immersive experience in coffee where the coffee is made for you in hot sand. UMLF: You recently started catering events and private parties, what are some of the goodies available? Elif: We did! We have a variety of house made dips, slow cooked Turkish vegetable salads, fresh salads and of course our Borek and Baklava! We offer our Borek in big family size spirals as well as Borek bites or even in portion sized triangles. We try and accommodate food allergies and make all our salads vegan and most GF. Our cakes are all GF and sold as whole cakes for parties and events. Baklava is always available in house for spur of the moment boxes of assorted flavors or ordered in bulk by the tray. UMLF: (If not answered above) Tell us about the Wise Dragonfly Collective. Elif: The Wise dragonfly is the overall umbrella company for the whole building. It is a creative collective with Kahve Café as the anchor store on the main floor. The second floor consists of micro businesses, art studios, and massage therapists. The main floor can be rented for events and gatherings as well as our multi-use room on the second floor and our loft on the third floor. I named it the Wise Dragonfly to pull in the old wisdom of gathering, community, and growth balanced w the dragonfly element of transformation. Our multi-use room on the second floor and the Dragon’s Loft can be rented by the hour or with a membership program of 5, 10 or 15 hours a month. We have various amenities with our rooms such as: a full set of charka sound bowls, 2 hand tied drums (bear & buffalo) tuning forks, massage table, Photo studio supplies (9 ft & 5 ft pull down screens) I affectionately call my businesses and tenants of the Wise Dragonfly, The Dragons of Downtown. We have become a small family and because of this, we are able to create a foundation to grow together. When one business grows, it lifts the others. UMLF: Every business has its highs and lows. Can you tell us about a challenge you faced as an entrepreneur and how you overcame it? Elif: Being an entrepreneur is a harder road than most. Having a brick-and-mortar shop amp up that exponentially. It pushes you to grow like nothing else. This year has been the biggest growth for me as a person than ever before. It is hard to be a boss as well as a landlord. I have cried and laughed about equally this year. It is no joke when they say you have highs and lows. Both extremes come into play with a first-year brick and mortar. It’s not just me and Mina any more to responsible for – Now it is 7 employees and 7 tenants that I carry with me in the decisions I make for the businesses. It is a choice to view it as a weight or a gift. I am hopelessly optimistic to a fault because I can see, feel, taste, touch the future. Holding that line and that vision keeps me going. It’s an interesting journey because you know that you will give your blood sweat and tears to make it work but you also have this peace that it is also ok if, despite all efforts, it doesn’t work. You have to let go of the fear of failure and embrace hope and vision. Be stubborn, but not rigid. I have learned that things always work out and not in the way your imagined. Surrounding yourself with people who can help you move past those bumps helps enormously! I am a high creative and all this business/financial stuff hurts my brain because at the end of the day, I just want to feed people and make them tea. Find people to help you in the areas that are not your strength. UMLF: How do you feel like the Utah Microloan Fund has helped your business? Elif: The UMLF has help me get my footing and get grounded in my business. The Funding helped me to expand our menu offerings and product lines to meet demands as well as hire staff to support me and the café as we grew. The classes and advisors there are always there to help me when I get stuck to get unstuck with alternatives and/or solutions. I have used UMLF for many years with the Banking on Women program and have met with them over the years as my baklava business grew. Their advice before I opened the café and now has been so appreciated because they understand my businesses and they know ME as a person and know how to help me through my weaknesses in order for me to grow and expand. Go have a cup of coffee and delicious treats at 57 600 E, Salt Lake City, UT 84102 Website: www.kahvecafeslc.com Facebook: www.facebook.com/kahvecafe Instagram: www.instagram.com/kahvecafeslc  Located in the heart of Millcreek, Retreatment Wellness is our July Business of the Month! Keep reading to learn more about Dr. Alessandra Young and her wellness center that will make you feel serene inside and out. UMLF: Hi Alessandra! We’re so excited to interview you as our Business of the Month. Tell our readers about yourself. Alessandra: I am a holistic healthcare provider with a Doctoral degree in Acupuncture & East Asian Medicine, specializing in the treatment of pain, anxiety, women's health, and facial rejuvenation. I have been a clinician at the Disney Cancer Center in Burbank, CA, and also at the Clinic for Pain & Anxiety in Beverly Hills, CA. For the past two years, I've been seeing patients at a clinic in The Avenues called Flow Acupuncture. I am proud of my work there, providing excellent care at a clinic that has been rated "Best in Utah" for the past two years by readers of the SLC Weekly. This accolade is a wonderful acknowledgment of the healing work done there. I moved to Utah in November of 2020 from Los Angeles to live in the mountains and enjoy the beauty of the four seasons. I have lived all over the country from New York City to a tiny town in New Mexico. I have traveled all over the world. So I say this as a person who has seen a lot of what the world has to offer: Utah is a beautiful and special place to live. My family and I are happy to be here and to be welcomed into this community. UMLF: What’s the story behind Retreatment Wellness and how did you get started? Alessandra: I started Retreatment Wellness to provide signature treatments that are unique to my skills and that use advanced technologies not available at other Acupuncture clinics - like Microneedling & LED Light Therapy & Sound Bath Meditation. I align beauty with health. I've created a place where, for example, you can take care of your back pain while also addressing signs of aging. Or, you can address the inflammation in your gut with acupuncture while also reducing anxiety while enjoying deep restorative meditation in a sound bath. The thing about facial rejuvenation acupuncture is that many of the points on the face that have cosmetic applications are also what we call "shen" or "spirit" points. "Shen" points are used to treat psycho-emotional disharmonies like anxiety and insomnia. So, it's a lovely two-for-one for women to have the benefits of great skin and a feelings of serenity in one treatment. I hope to have created efficiency around self-care by providing multiple healing and beauty modalities in one session. The need for this business arose in my mind when I was treating a patient with an Acupuncture Sound Bath at a busy clinic. The patient was having a personal and transformative moment that deserved quiet and privacy but instead there was a loud and busy conversation right outside of the door that interrupted the sacred space that had been created. This experience, and also my personal experiences of healing while in retreat, brought to mind how important quiet, peace and privacy are to deep healing. To start my business I needed to find the perfect venue. When I walked into the private, peaceful, second-floor suite at Soma Sage & Soul, I knew that I had found the place! Soma Sage & Soul is a holistic healing collective in Millcreek in what was once a family home - so it feels safe and warm and homey. The collective are highly credentialed women practitioners offering yoga therapies, massage, pelvic floor therapies, and talk therapy - we're a well-rounded bunch with a broad set of skills. (Pun on the word "broad" was intentional!) There is also a community room where I hold Sound Bath Events that are open to the public. I hope that I have created a space and an experience that is like being on a retreat - where transformative body, mind & spirit healing occurs. And where you can address the signs of aging. UMLF: For someone new to acupuncture and Eastern medicine, what can they expect from their first treatment? Alessandra: Relaxation. I know it sounds strange because the idea of getting poked with needles is less than relaxing for any reasonable person. But what studies have shown is that Acupuncture is excellent for reducing inflammation and it causes a cascade of "feel good" neurotransmitters. With a reduction in inflammation, your body can start healing itself. And with the "feel good" effects people usually report having an excellent night's sleep and a lifted mood. UMLF: You have some cool retreats and events coming up, tell us about those? Alessandra: Twice monthly on Wednesday nights, I guide a community sound bath meditation with Acupuncture. It's a way for people to more easily access deep meditative states. Many people think that they can't meditate, so they don't benefit from a practice that is proven to improve measures of health and well-being. And sometimes experienced meditators become frustrated with their practice because they are experiencing blocks. The binaural beats created by crystal singing bowls entrain the brain to operate in meditative brain wave states. The acupuncture allows the body to more easily "downshift" into the "rest, relax and repair" aspect of the nervous system. So, I like to say it's like meditating with "training wheels" - it makes the practice easier for most people. Of course, if a person just wants to experience the sound bath without needles, that is also beneficial. I'm so excited about the retreat! It's an immersive healing experience at Maple Grove Hot Springs in Idaho from Sept 30 - Oct 3rd. It's going to be like summer camp for adults but with yoga and sound bath meditations and acupuncture and reiki and group shadow work and bodywork and hot springs and autumn colors... *sigh* It's an opportunity for people who have felt overwhelmed and anxious to reset their nervous system and feel supported in community. UMLF: Every business has its highs and lows. Can you tell us about a challenge you faced as an entrepreneur and how you overcame it? Alessandra: As a start-up business the greatest challenge has been learning how to differentiate myself in the marketplace and attracting customers. This is something I am currently working to "overcome." Certainly, opportunities like this interview are so valuable - to be "seen." There has been a lot of trial and error with Google Business and Google Ads and SEO companies etc... And then there is the social media aspect with the constant refining of messaging etc... Hiring people to manage all of these aspects is not financially feasible for a start-up of my size. So, it's a lot of work and the mistakes are costly. I am currently discovering how valuable professional partnerships are to the viability of new businesses and this is where UMLF comes in... UMLF: How do you feel like the Utah Microloan Fund has helped your business? Alessandra: The UMLF has been integral to every aspect of my business. The thoughtful review of my business plan caused me to rethink and refine some of my approaches which saved me from making some poor decisions. And now I am benefitting from coaching around marketing my business and understanding the best practices to develop new business in these high-pressure economic times. UMLF has helped by always offering expert advice and support. I am so grateful for the support. Aw thank you! To book a session with Alessandra visit:

Lacey Bagley - Owner/Clinical Director Lacey Bagley - Owner/Clinical Director This is the place. Utah has been known for the best snow on earth, amazing national parks, a flourishing culinary scene, real housewives, a stellar economy, low unemployment, the list goes on. But did you know Utah also has a higher suicide rate than the national average? On top of that LGBTQ+ adults are two times more likely to attempt suicide compared to heterosexual adults. For LGBTQ+ youth the risk is even higher. With a largely conservative culture, where can people go for love and support while navigating their personal journeys with their identity? Where can families go for resources on how best to support their loved ones? Enter Celebrate Therapy. We interviewed Owner/Clinical Director Lacey Bagley to share with all of you this gem of a resource to our Utah community. Find out more about our June Business of the Month below. UMLF: Can you tell us about yourself and the team behind Celebrate Therapy? Lacey: "Hi, I'm Lacey Bagley and my pronouns are she/her. I'm a licensed Marriage and Family Therapist in the state of Utah and I'm the Owner/Clinical Director of Celebrate Therapy. Celebrate is comprised of a team of queer clinicians and together we provide LGBTQIA+ affirming mental health services to the queer community all across Utah! I grew up in northern Minnesota and bring a lot of the northland into my therapy practice by creating a safe, nurturing environment for queer people to grow and learn to celebrate their unique identities." UMLF: For those who are new to the concept, tell us about Queer Therapy and why it’s so essential to our Utah community? Lacey: "Celebrate Therapy is the very first clinic in Provo and the surrounding area that is owned and run by a team of queer clinicians. First and foremorest, we work to support clients in becoming confident and supported in their own queer identities. We also work alongside family members who are learning how to create, strengthen, and promote support for their queer loved ones. We hope to lead a transformational change in Utah County and beyond! Our goal is to help client's and family members nurture and grow their authenticity, in whatever way they need to. To the queer community: you, your loves, and your family are important to us and we promise to courageously advocate for you and the larger queer community in Utah County." UMLF: Who could best benefit from your different therapeutic services? Lacey: "We provide therapy services to anyone in the LGBTQIA+ community, as well as their family members. Many of us are trained family therapists, so we enjoy working with family systems. Overall, we provide therapy to entire families, parent-child dyads, couples and/or polyamorous networks." UMLF: Do you do telehealth as well as in person? Lacey "We provide both telehealth and in-person services. You can find out more at our website, www.celebratetherapy.org and online at our social media accounts at @celebratetherapy." UMLF: Can you tell our readers about additional resources and services that you provide? And community partners you recommend? Lacey: "Other resources we offer include group therapy and political advocacy work in the community. We are excited to celebrate June as Pride month and will have a booth in SLC this upcoming weekend at Utah Pride Center's Pride Festival. Please stop by and say hi! As far as the larger community goes, we work closely with community partners like LGBTQ.UT, Encircle Therapy, and Flourish Therapy. For BYU students, we partner and are involved with affirming organizations like USGA, The RaYnbow Collective, and Cougar Pride Center. And for UVU students, we endorse Spectrum as a community of support and celebration!" UMLF: How can allies best support our queer community during Pride month and beyond? Lacey: "To affirm LGBTQIA+ members, you can practice sharing your own pronouns during introductions as well asking others for theirs until it becomes a habit. Together, we can strive to create safe havens in our community where the freedom to express queer identities thrives, and where individual rights and needs feel advocated for. Finding, supporting, and promoting small businesses owned and operated by LGBTQIA+ members is another great way to support the community every day." UMLF: How do you feel like the UMLF has helped your business grow? Lacey: "We used the UMLF to consolidate startup fees which has given us the foundation from which we’re able to thrive and grow from. We plan to continue working together to empower LGBTQIA+ mental health providers to start their own clinics across the state of Utah." Thank you Lacey and your team for the amazing work you do! ❤️  Executive Director Liz Pitts Executive Director Liz Pitts Spring has sprung, love is in the air, and folks, Pride Month is here! Is there a better time to feature our friends at the Utah LGBTQ+ Chamber and the awesome work they do? They serve as a connector across the state, bringing the community together through business while advocating for civil rights and small business. The chamber is open to all sizes of business, regardless of sexual orientation, gender identity, or gender expression, yes that includes allies too! Keep reading as we interview Executive Director Liz Pitts below. ✨ UMLF: Liz, tell us about yourself and your journey with the chamber? Liz: “I'm a Salt Lake City native and have for many years been a social justice activist and community volunteer in Utah and elsewhere. I served as the Utah Pride Festival Director in 2017 & 2018; was on the founding Board of Project Rainbow Utah and am one of the producing directors of the Redrox Music Festival. I earned bachelors degrees from the University of Utah in Women's Studies & Political Science and a Masters of Library and Information Science from the University of Washington. I'm a librarian by trade and worked for many years in enterprise system sales, technical sales operations, event management, and training before pivoting to a career in local LGBTQ+ non-profit work. I'm a mother and an avid skier. I love travel, live theater, all things outdoors, and I operate a ski lift in my spare time. I joined the Utah LGBTQ+ Chamber in 2019 and was immediately impressed with the entrepreneurial spirit and sense of community & affinity which permeates this group of hard-working, fun-loving business owners. In January of 2020 I joined the Chamber Board of Directors and helped to advance the programming and membership of the Chamber throughout the COVID pandemic. Up until November of 2021 the Utah LGBTQ+ Chamber of Commerce was a volunteer run organization. A very dedicated board of directors team, led by Tracey Dean, kept the Chamber growing steadily and the programming focused and impactful. It became very clear however that our growth and potential were outpacing our volunteer capacity, so the decision was made to hire our first-ever paid employee. I am honored to have been selected to fill this role and am excited to continue to work toward social justice for LGBTQ+ and allied business owners and contribute to the overall economic health of our State.” UMLF: Y’all have a ton of fun events and happenings. Can you tell prospective members what they can expect? Liz: “Yes, all work and no play... JK. Our annual flagship events are our springtime Queer Food FEASTival & Membership Drive and our Utah LGBTQ+ Economic Summit. Through these events we mix networking, education, and community connection to provide spaces for LGBTQ+ and allied business owners to come together, learn from and support each other, and have a great time while doing so! We also offer a number of educational workshops and networking events throughout the year including our 3rd Thursday breakfasts (being held on the Sugarhouse Coffee patio monthly throughout August - 7.30-9a ) and Taste of Success Best Damn Lunch & Learns. All of these events are open to chamber members and prospective members alike and, if you join in, you can expect lively conversation on topics of importance to LGBTQ+ business owners, lots of business referrals and a good time!” Save the Dates: - The 4th Annual Utah LGBTQ+ Economic Summit will be held September 22nd in the Zion's Bank Founders Room in downtown SLC and will be broadcast for remote attendance - The 2023 Queer Food FEASTival will be held May 12th UMLF: Tell us more about the LGBT-Owned Business Enterprise Certification and why business owners should consider applying? Liz: “As an affiliate of the NGLCC (National LGBT Chamber of Commerce), we offer guidance and support to local LGBTQ+ owned and operated businesses who choose to become LGBTBE (r) certified. Chamber members whose businesses are at least 51% LGBT owned are eligible to certify through the NGLCC free of charge. LGBTEBE (r) certification opens many doors for small business owners and opportunities to connect with and win contracts from local and national corporations, institutions of higher learning and government entities.” UMLF: You also have an awesome program, Utah LGBTQ+ SafeZone. Can you share more about it? Liz: “Absolutely! SafeZone Utah is the key program of the Utah LGBTQ+ Chamber Foundation 501c3. SafeZone works to increase local business owners’ understanding of experiences and issues faced by LGBTQ+ community members, and to educate them about how they can take a leading role in the effort to provide allyship and create safe, inclusive spaces for LGBTQ+ employees, customers and community. The goals of SafeZone Utah are to promote LGBTQ+ safety and sense of belonging statewide; to raise awareness among business owners about the importance of supporting LGBTQ+ inclusivity and equity; to reduce bullying and harassment of LGBTQ+ people; and reduce suicide risk in the LGBTQ+ community. We do this by offering free training to small businesses and nonprofit organizations throughout the state; and offering the opportunity for businesses to become designated LGBTQ+ SafeZones, where community members can access resources, information, and safety, if needed. This effort is especially important in the many rural communities of Utah that lack culturally-competent, LGBTQ+ affirmative services and safe environments where members of the LGBTQ+ community can freely and safely express their identities and participate or see themselves represented in all spheres of community life, including leadership, government, business etc.” UMLF: How can allies best support during Pride month and beyond? Liz: “There are so many ways allies can support LGBTQ+ folx throughout the year and one great way is to support the local businesses who serve the community! Shop, eat, drink, get a new roof, find great health service providers and more in our member directory!” ❤️ - To stay in touch with the Chamber visit below -❤️ Website: www.utahlgbtqchamber.org Facebook: www.facebook.com/utahlgbtqchamber Instagram: www.instagram.com/utahlgbtqchamber It's no secret we live in the digital age. With meetings on Zoom, hangouts in virtual reality, instant streaming, and texting/emailing being king, it's important we still show people we time and care offline as well. One easy way? Sending a thoughtful card in the mail. Old fashioned? Heck no! That's where our May Business of the Month Mailed It!, a women-owned greeting card subscription company, comes in. Keep reading to learn about Mailed It! from owners Kendall Watson and Ashleigh Phillips below.